News

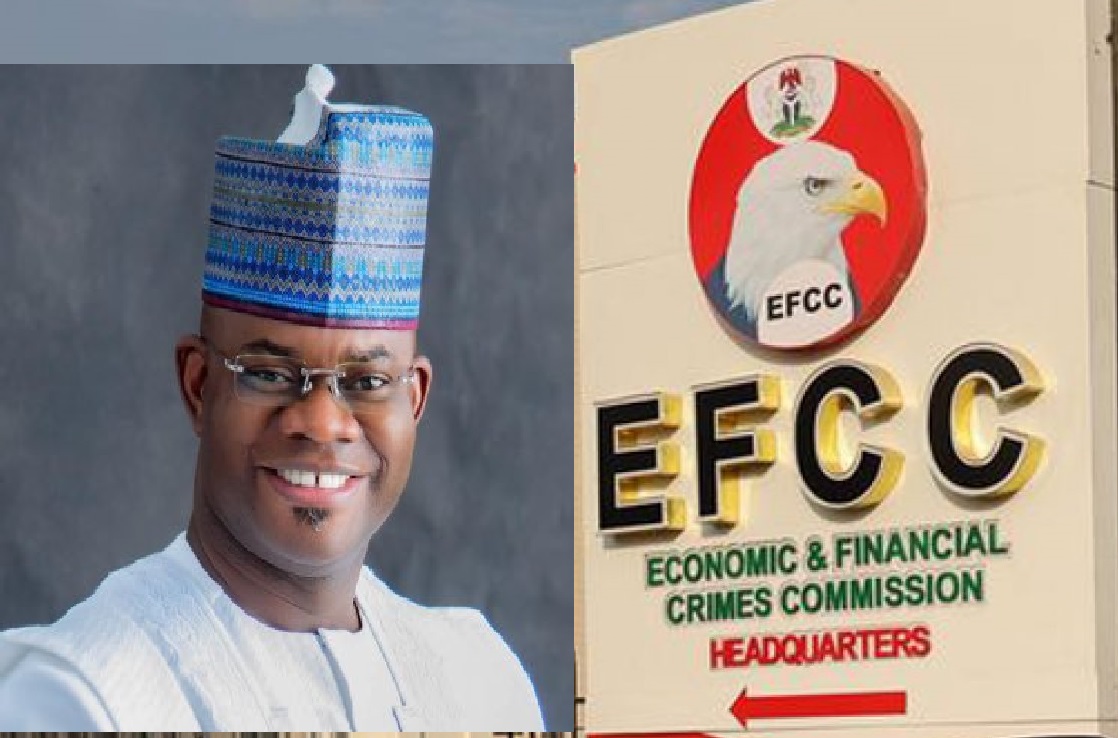

EFCC vs Yahaya Bello: Transactions complied with CBN rules, witness tells court

An Economic and Financial Crimes Commission (EFCC) witness in the ongoing money laundering trial of former Kogi State Governor, Yahaya Bello, has insisted that the cash withdrawals referenced in his testimony were carried out in accordance with the guidelines of the Central Bank of Nigeria (CBN).

The witness, Olomotane Egoro, the 10th prosecution witness and a Compliance Officer with Access Bank Plc, told the court that he has been with the bank since May 2023.

While testifying, Egoro confirmed that Aminu Olanrewaju, who was said to have made withdrawals from the Kogi State Government House Administration Account, was a signatory to the account. Under cross-examination, he disclosed that Olanrewaju was a civil servant serving as Director of Accounts in the Kogi State Government House Administration.

He explained that, as a bank official, he was not involved in the internal operations of the Kogi Government House Account and could not determine the purpose of withdrawals beyond what was captured in the transaction records. He noted that his testimony was consistent with evidence earlier presented before Justice Emeka Nwite of the Federal High Court in Abuja.

The witness also admitted that Yahaya Bello was neither a local government chairman nor was his name linked to any of the transactions tendered before the court, including those involving various local government areas in Kogi State and companies such as Fazab Business Enterprise.

According to Egoro, the purposes of several payments ranged from the purchase of sporting equipment to agrochemicals, farm inputs, and medical consumables. He cited specific transactions, including a N10.6 million lodgment from Ibaji Local Government for agrochemicals, N7.3 million from Mopa Muro Local Government for relief materials, and N9.9 million from Ofu Local Government for the procurement of agrochemicals.

During examination-in-chief, the court admitted into evidence a subpoena signed by the Managing Director of Access Bank. The subpoena contained statements of account for the Kogi State Government House Administration from January 2016 to January 2024, as well as account statements of several companies, including Westwood Motors Limited, Fozad Oil and Gas Limited, Bespoque Global Concept Limited, E-Traders International Limited, and Keyless Nature Limited.

Counsel to the second and third defendants objected to the admissibility of the documents, arguing that the certificate of identification failed to meet the requirements of the Evidence Act, and stated that detailed arguments would be presented in the final written address. In response, prosecution counsel, Kemi Pinheiro, SAN, described the objection as a fishing expedition and said his response would also be detailed at the appropriate stage.

Justice Maryann Anenih admitted the documents but noted that their admissibility would be revisited if the objections were later found to be valid. The Kogi Government House Administration Account was marked as Exhibits AH1 and AH2, while the statements of the 11 other companies were labelled Exhibits AG to AR.

The prosecution further directed the witness to confirm credit inflows into Exhibit AH1 between December 2018 and August 2019, as well as withdrawals made by Aminu Jimoh Olanrewaju and Abdulsalami Hudu, which he confirmed. The witness also acknowledged multiple cash withdrawals in December 2018 and January 2019, adding that Access Bank filed a Suspicious Transaction Report with the Nigerian Financial Intelligence Unit (NFIU) in line with standard procedure.

He noted that several credit inflows from local government areas were recorded in May 2022, alongside cash withdrawals by Yakubu Siyaka Adabenege.

However, under cross-examination, Egoro maintained that no law was breached, reiterating that all the transactions complied with CBN regulations.

Justice Maryann Anenih adjourned the case to March 10, 11, and 12, 2026, for the continuation of the witness’s cross-examination.