Business

Finance Minister speaks on 5% fuel surcharge implementation

The Federal Government has clarified that it has no immediate intention of implementing the five per cent fuel surcharge referenced in the newly signed Tax Administration Act 2025.

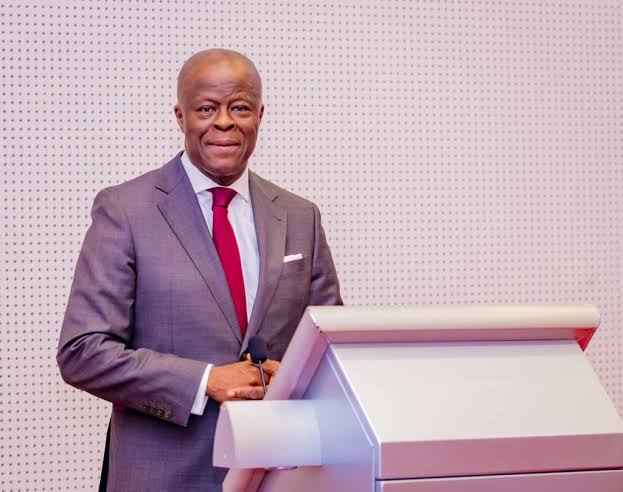

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, made the disclosure during a press briefing in Abuja on Tuesday, stressing that the provision is not a new levy introduced by the Tinubu administration.

He explained that the surcharge dates back to the Federal Road Maintenance Agency (FERMA) Act of 2007 and was only consolidated under the 2025 legislation to streamline existing tax laws.

“It is important to make this distinction, the inclusion of the surcharge in the 2025 Nigeria Tax Administration Act does not mean an automatic introduction of new tax. It doesn’t mean fresh taxation automatically,” Edun said.

The minister noted that the law would officially come into force on January 1, 2026, but its implementation still requires a commencement order issued by his office and published in an official gazette.

“There is a whole formal process involved, and as of today, no order has been issued, none is being prepared and there is no plan. There is no immediate plan to implement any surcharge,” he stressed.

Edun described the Act as part of a broader reform agenda designed to modernise Nigeria’s fragmented tax system. Alongside the Tax Administration Act, three other bills—the Revenue Service Bill, the Joint Revenue Board Bill and the Tax Reform Bill—were passed to enhance transparency, simplify compliance and improve efficiency in revenue collection.

“This is a transformational legal document,” he said, adding that the reforms are the product of years of consultation and technical work.

He also highlighted that implementing the reforms would require significant groundwork, including institutional restructuring, training, and public awareness campaigns.

According to Edun, the government’s approach is aimed at easing economic pressures rather than adding to them.

“This government is fully aware of the economic pressures of the time and will not take decisions that will make things even more burdensome. Our priority is to strengthen tax governance, block revenue leakages, and improve efficiency rather than just levy new taxes, charges, and costs,” he said.

The minister noted that the administration’s wider economic policies are already restoring investor confidence, with positive signals coming from international rating agencies and development partners.

“As you know with all policies, once the policy is passed into law, the next step is implementation. There will be publicity, sensitisation, education and information on the new tax law,” Edun explained.