Crime & Law

EFCC arraigns director for alleged N13.8b ponzi scheme fraud

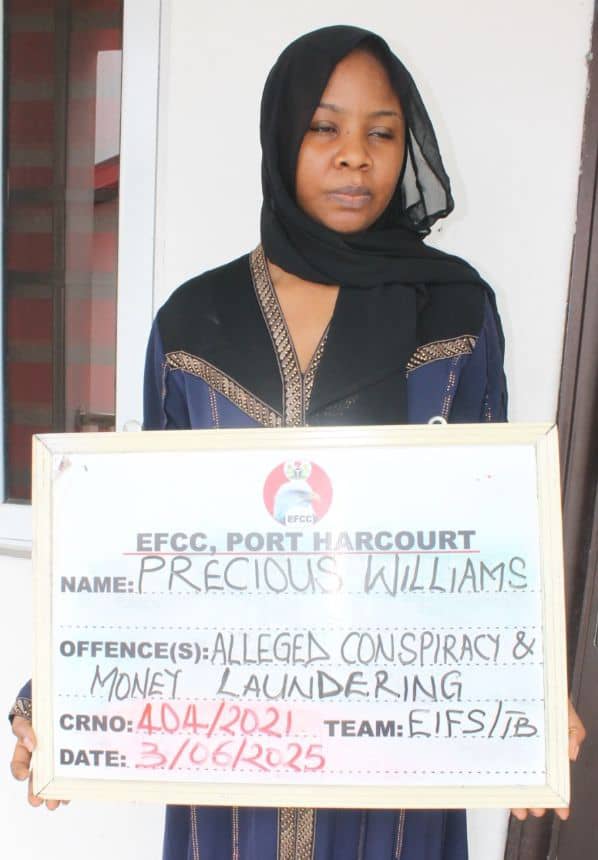

The Economic and Financial Crimes Commission (EFCC) has arraigned Precious Williams, a director at Glossolalia Nigeria Ltd and Pelegend Nigeria Ltd, over a staggering N13.8 billion money laundering case linked to a fraudulent investment scheme.

Williams was docked on Monday before Justice S.I. Mark of the Federal High Court in Port Harcourt, Rivers State, on a 14-count charge that includes money laundering, conspiracy, advance fee fraud, and obtaining money under false pretence.

According to the EFCC, Williams allegedly masterminded a fake investment scheme through which she and her companies defrauded unsuspecting victims of billions of naira. The funds were reportedly funneled through her companies under the guise of offering high returns on investment.

Court documents revealed that the fraudulent activities were carefully orchestrated and involved multiple accounts and corporate fronts used to mislead investors and launder the proceeds.

READ ALSO: EFCC declares oil company’s boss wanted over alleged N976.65bn subsidy fraud

A statement shared by EFCC spokesperson Dele Oyewale, on Monday, said the charges stemmed from a complex fraud allegedly orchestrated in collaboration with Maxwell Chizi Odum (still at large) and MBA Trading and Capital Investment Limited (also at large).

He stated that the defendant allegedly received billions of naira into various corporate bank accounts as part of the scheme.

According to the anti-graft agency, Ms Williams used different entities for the scheme. They are Glossolalia Nigeria Limited, Pelegend Nigeria Limited, Phenom 413 Events Limited (company representative at large) and Doxasterz Oil and Gas Limited.

One of the counts alleged that, sometime between 24 August 2019 and 15 February 2020, she took possession of N10 billion from Maxwell Chizi Odum and MBA Trading and Capital Investment Limited through Sterling Bank account number 0064260799, knowing the funds were proceeds of unlawful activity involving over 3,000 unsuspecting investors.

Another charge alleged that Ms Williams, through a Polaris Bank account, received N1.005 billion between December 2019 and November 2020, knowing the money was part of fraudulent proceeds.

The EFCC said the funds were collected under the false pretense of offering 10 to 15 per cent monthly returns on investments, which were never paid back.

Ms Williams pleaded not guilty to all charges during her arraignment on Monday.

Following her plea, prosecution counsel E.K. Bakam requested the court to remand the defendant and fix a date for trial.

Defence counsel Tochukwu Maduka, who is a Senior Advocate of Nigeria (SAN), informed the court of a pending bail application.

Mr Maduka urged the court to grant bail to allow the defendant to prepare for her defence.

However, the prosecution opposed the application, arguing that it was premature as it was filed before the charge amendment and formal arraignment.

Mr Bakam asked the court to reject the application and request a fresh filing.

Mr Mark ruled in favour of the prosecution, ordering that the defendant be remanded in the Port Harcourt Correctional Centre.

The judge adjourned the matter to 17 June for a bail hearing.

How the scheme worked

According to petitions received by the EFCC, Ms Williams was involved in the collection and laundering of funds from thousands of Nigerians who invested in MBA Trading and Capital Investments Limited between 2019 and 2020.

The firm, via aggressive marketing by agents and social media promotions, promised 10 to 15 per cent monthly returns, with a six-month lock-in period after which capital could be withdrawn or reinvested.

But many victims were reportedly lured in by promises of guaranteed returns and ended up losing their capital.

EFCC warns against ponzi schemes

The EFCC has repeatedly warned Nigerians to avoid Ponzi schemes. On 9 May, the Acting Zonal Director of the EFCC Enugu office, Assistant Commander of the EFCC Aisha Abubakar, issued a fresh warning during the Nigeria Security and Civil Defence Corps’ 2025 Annual Management Retreat in Enugu.

Speaking on the topic “Get-Rich-Quick Syndrome and the Youth Vulnerability”, she said Ponzi schemes have “destroyed lives, eroded trust, and undermined national development.”

She blamed rising youth involvement on financial illiteracy, peer pressure, digital exposure, and social media-driven fantasies of wealth.

She cited schemes like MMM Nigeria, MBA Forex, Chinmark Group, and the recent collapse of CBEX, which promised 100 per cent ROI within 30 days, as examples of destructive financial frauds masquerading as investment platforms.

The EFCC said it is continuing efforts to track down other suspects in the MBA investment fraud, including Maxwell Odum, and others currently at large.

The commission also recently secured a final forfeiture order on over N6.67 billion worth of shares and funds traced to Cititrust Holdings Plc—another company accused of operating a Ponzi scheme.

In March 2025, EFCC operatives arrested 28 suspects in Minna, Niger State, for operating Q-Net Ltd, a fraudulent investment platform disguised as network marketing.

The suspects allegedly collected between $790 and $850 (N1.46 million) per person from victims under the guise of international affiliations.

EFCC’s preventive role

Ms Abubakar stated that beyond enforcement, the commission is prioritising prevention through roadshows, digital campaigns, and partnerships with financial regulators like the Central Bank of Nigeria, SEC, and international bodies including INTERPOL.“

“Cybercrime has created a market system where fraudsters obtain a competitive advantage and drive out legitimate businesses,” she said. “This undermines national defence, global trust, and the Nigerian economy.”